Investing for Income: How to Buy Municipal Bonds

Municipal Bonds for Tax-Free Income

As I write this, the stock market is on an upswing, however, the last few months have been like a rollercoaster for investors owning stocks. If this volatility has you up at night, you've probably considered moving to safer investments. Unfortunately, the typical safe investments such as savings accounts, money market accounts, or Treasury Bonds, provide anemic returns. So what's an investor to do? One option that's not often considered is municipal bonds. If you're looking for relative safety and tax-free income, municipal bonds may be an option for you, especially if you're in a higher tax bracket. In fact, right now, municpal bonds have rate of return higher than Treasury Bonds, something that doesn't happen very often. Read on to learn about what municipal bonds are and how to buy them.

What are Municipal Bonds?

States, cities, counties, and local municipalities in the United States often need to raise money for projects, including things like toll roads, bridges, schools, and sports stadiums. Often, these projects are funded by borrowing. In other words, the municipality will issue bonds. Investors who purchase the bonds are essentially loaning the municipality money to fund a specific project.

There are two types of municipal bonds.

- General Obligation Bonds: These bonds are used by municipalities to fund general operating expenses. They're backed by the taxing power of the municipality issuing them.

- Revenue Bonds: Revenue bonds are issues to raise money to fund a particular revenue generating project. The bond interest and principal are repaid with the funds that are actually generated by the project. For example, if a toll road is built, the tolls will help pay the interest and principal to lenders.

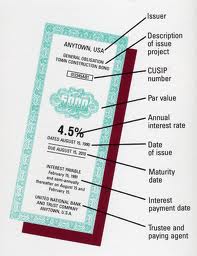

There are several terms you need to become familiar with if you're interested in purchasing municipal bonds.

- Par value: This is the value of the bond and the price you pay if you purchase the bond at the time it's issued. Municipal bonds are typically sold in increments of $5000 with a $5000 minimum investment.

- Interest rate: This is the rate the municipality agrees to pay you. The interest rate on municipal bonds is paid free of federal taxes and is also free of state taxes if you live in the issuing state. Some municipal bonds have fixed interest rates while others carry variable rates. A variable rate will rise and fall with prevailing interest rates and can be a good choice for those who are buying long term bonds.

- Maturity date: This is the date that the par value or principal will be returned to you in full. If you hold the bond to maturity you'll receive your entire investment back. On the other hand, if you decide to sell the bond before maturity, its value could be more or less than what you invested, depending on interest rates at the time. If interest rates are higher, the value of your bond will fall and if interest rates are lower, the value of your bond will rise.

- Interest payment date: This is the date that interest will be paid. Interest on bonds is generally paid twice a year, every six months.

How Safe Are Municipal Bonds?

Recently there's been a lot in the news about how many municipalities are struggling to pay their bills and remain above water. California is in a big budget mess and Wisconsin's recent budget cuts brought out protestors. Most recently, Harrisburg, Pennsylvania filed for bankruptcy protection. These headlines might convince you that loaning money to municipalities is risky. I agree that there are real risks in buying municipal bonds in this environment. However, by carefully selecting the bonds you purchase, you can mitigate much of this risk.

If you're concerned about defaults, consider data showing just how safe municipal bonds have been historically. From 1970 to 2000, the 10 year cumulative default rate for municipal bonds was .04 percent. This is compared to 9.83 percent for corporate bonds. In addition, if a municipality does default, most laws require interest and principal payments to bond holders to be paid from tax receipts as a second priority only to primary education.

To make it easier to assess the risk of various bond offerings, ratings agencies such as Moody's and Standard & Poor's evaluate and rate bond offerings using a letter rating system. In general, bonds with a BBB or Baa or better rating are considered safe and appropriate for capital preservation objectives.

Default isn't the only type of risk associated with buying municipal bonds. An investor must also be concerned with interest rate risk, tax bracket changes, call risk and market risk.

Interest rate risk occurs when rates rise in the marketplace. You'll be left holding a bond at a lower rate compared to newly issued bonds.

Tax bracket changes also result in risk to the investor of municipal bonds. This is because the lower your tax rate, the less benefit you get from tax free investments like municipal bonds.

Call risk is the risk that the municipality will pay off the loan early. If this happens, you'll get a premium payment for your trouble and you'll get your entire prinicipal back. However, you'll lose out on the opportunity to receive future interest payments from that bond.

Finally, market risk occurs when prevailing market interest rates rise compared to the interest rate being paid by the bond you hold. If interest rates rise in the market place, investors will be less interested in purchasing your bond at the lower rate. As a result, the price for your bond will fall if you decide to sell it before maturity. This goes the other way as well. If market interest rates fall, your bond will look attractive at the higher rate and the value of your bond will rise. Market risk can be eliminated by holding a bond to maturity.

- Municipal Bond Tax Equivalent Yield - Financial Calculators from Dinkytown.net

Income generated from municipal bond coupon payments are not subject to federal income tax and often are exempt from state taxes. Use this calculator to estimate the tax-equivalent yield (TEY) for a municipal bond. Investment Calculators and tools fo

- Investing for Income: How to Set Up a Dividend Stock...

In today's interest rate environment, it's difficult to achieve a higher return than about 1%. Rather than relying on low rates, investors can purchase the dividend stocks of large, stable companies and achieve returns of 7-8%. - Investing for Income: How to Buy Treasury Bonds

Treasury bonds are one of the safest investments around yet many people don't understand them or know where to purchase them. This article will tell you all you need to know about treasury bonds and how to purchase them.

How do I Buy Municipal Bonds?

There are several buying strategies to employ when considering municipal bonds. Which you select will depend on your investment objectives and risk tolerance.

The most basic strategy is to purchase a bond at an attractive interest rate and hold it to maturity. This strategy is safe but does carry interest rate risk. To mitigate this, a bond ladder can be created. This calls for purchasing a series of bonds with sequential maturity dates. For example, the first bond might mature in one year, the second in two years, and so on. As each bond matures, you can purchase a new bond to extend the ladder. This ensures that you'll be taking advantage of rising rates, if that occurs. An active trading strategy is the most sophisticated way to buy municipal bonds. This allows the investor to take advantage of capital appreciation that may occur due to changes in market interest rates.

So now that you've decided to purchase municipal bonds, where do you start? The first step is to find a bond broker. There are some brokers who specialize in bonds but you can also buy them from one of the many Online stock brokerages that exist in the marketplace. Some potential options are:

- Vanguard

- Fidelity

- TD Ameritrade

- Schwab

- Scottrade

- eTrade

To evaluate an individual bond, you must first know your combined Federal and State Tax rate. If, for example, you're in the 25% Federal Tax Bracket and your State assesses a 3% tax rate, your combined rate is 28%. You can then use the Tax Equivalent Yield Calculator (link is above) to determine the equivalent yield you'd need to obtain from a taxable investment. If the tax free bond has a higher equivalent yield than the taxable investment, you should go for the tax free investment. You should, of course, also evaluate the municipality issuing the bond by looking at the ratings and by perhaps doing a little Online research on the project or funding needs. If it looks to be a safe bet with a high yield, then you can go for it.

Municipal Bonds: Another Tool in Your Investment Toolkit

If you're tired of the volatility of the stock market but are looking for higher returns than you can get in a savings or money market account, consider municipal bonds. These investments are tax free and have a historically low default rate, making them a great choice for conservative investors and those in high tax brackets looking for tax free income.