Surefire Tips for How to Reduce Your Living Expenses

Lately, it seems that you can't watch television or browse the Internet without seeing numerous tips for how to cut your living expenses. Everyone is trying to live smaller. I'm no different. I woke up one day last year and realized that if I don't get my financial life in order, I may not be able to help my children with their college educations or retire from my job. So, I decided to do something about it. What did I do? I started by tracking my expenses and income. I realized that in order to figure out how to save more, I had to know where I stand right now with earning and spending. The process I've been using, which was inspired by the book "Your Money or Your Life," has been successful in that I've managed to cut my living expenses and have started to put aside money for the future. Give it a try. It may work for you too.

Develop a Method to Track your Income and Expenses

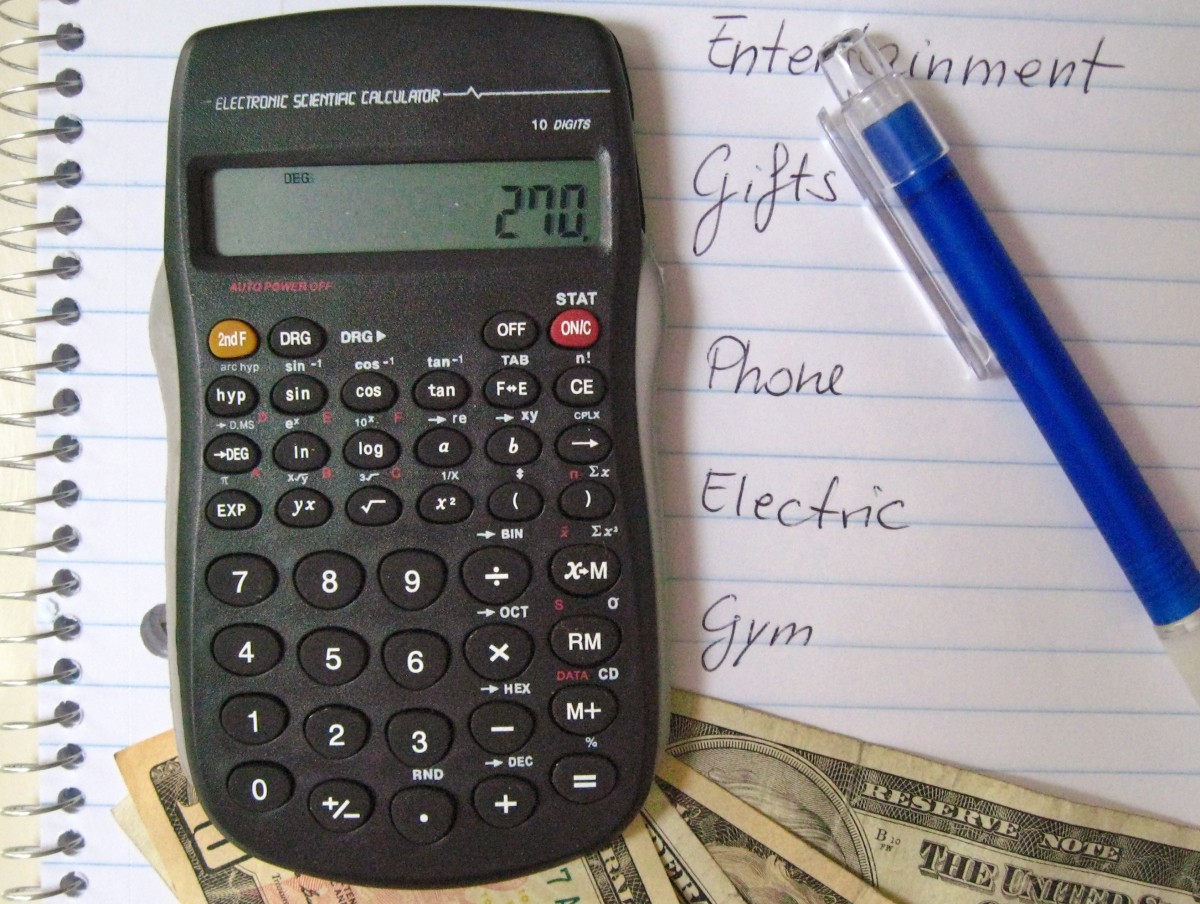

The first step to cutting your living expenses and saving more is to learn exactly how much income you take in every month and exactly how much you're spending. Don't make the mistake of thinking you know these numbers. Unless you actually write down every dollar you earn and spend, you're likely to be way off. I know I was surprised when I started keeping track. Was I really spending that much money on groceries? It costs me how much to commute to work? Even though I thought I had a handle on it, I had no idea what I was spending every month for various types of expenses.

The only way to know where you stand is to develop a tracking system. There are many ways to do this but here are two easy examples to start with.

- Buy a small notebook to keep in your purse or pocket. Write down everything you earn or spend, along with the category it falls into. For example, you'll likely have categories for groceries, eating out, gasoline, and rent or mortgage. How you split up the categories is up to you. Just make the categories specific enough to be meaningful.

- If you have an iPhone, iTouch, or a similar device, download a budgeting application. The one I use is called AceBudget and it's great. You set up your categories and your budget allocation for each. Then you just enter each expense or income as it occurs. Don't worry about getting the budget allocations correct. At first, you should only track what you spend but don't necessarily to to control it through a budget.

At the end of each month, I transfer my data to an Excel spreadsheet on my computer. I have it set up so that the difference between my income and my expenses is calculated automatically and recorded as savings. I then take this amount of money and transfer it to my savings account. I also have a line chart set up that shows my income and expense trend over time. It's really powerful to see it visualized because the space between the two lines represents savings. Hopefully, this will grow over time.

If you don't have Excel or simply don't want to take this step, just calculate the difference between your income and expenses and transfer that amount to your savings.

- Why Less Stuff Will Lead to More Happiness

Research shows that owning more stuff doesn't lead to lasting happiness. Instead, spend your money wisely on experiences with those you love and watch your happiness multiply. - Why Your Retirement Savings May Be Enough After All

Financial planners usually advise their clients to plan to need 80% of their pre-retirement income in retirement. New research conducted by the National Bureau of Economic Research challenges that assumption. - Eliminate Debt and Increase Wealth by Changing How You Think About Money

By changing how you view money, you can eliminate debt and build wealth. - Investing for Income: How to Set Up a Dividend Stock Portfolio that Returns 7%

Investing in dividend stocks is a great way to earn a higher return on your investments. Anyone can do it, even the smallest investor. As dividends are reinvested back into the companies you own, your wealth will grow. - Investing for Income: How to Buy Treasury Bonds

- 5 Steps for How to Achieve Financial Independence

Financial independence means having sufficient personal wealth to cover your living expenses from sources other than employment. The allure of financial independence is obvious.

Where Do You Stand?

After tracking your income and expenses for a few months, you'll have a good feel for where you stand. Do you spend more money than you take in? Do you have a small cushion for savings at the end of the month but want to increase it? Either way, you'll need to spend some time looking at the numbers in order to get to your goal. Start with the large buckets of expenses which are likely to be your mortgage or rent payment, car payment, gasoline, and groceries since these larger expenses may have more potential for savings.

- Mortgage or rent: Most people don't consider making changes here because there are costs to downsize but there are other options. Can you refinance your mortgage with a lower rate? Can you take in a renter to share in the cost? Could you move to a less expensive home or apartment?

- Car payment and gasoline: Are you driving a gas guzzler? Can you take public transportation? Ride a bike to work? Carpool? Can you sell your car and buy a less expensive car for cash, eliminating your payment?

- Groceries: Stock up on meat and poultry when it's on sale and freeze it. Shop with coupons and try to find a grocery store that doubles them. Cook instead of eating out or getting take out. Buy whole foods instead of convenience items. Cooking doesn't have to be a daily chore. You can cook extra food each time you cook and eat the leftovers for a day or two after the first meal.

Take a look at your other expense categories as well. Is there something you're spending your money on that you really don't need? Some people routinely buy items they don't need out of habit. My habitual purchase was magazines, which I would mindlessly buy. When I realized how much I was spending on them, I stopped. I went through every category and evaluated it according to whether or not I was actually getting satisfaction from those purchases. It helped me decide what to stop spending money on and what to continue spending on.

See Your Savings Grow

Over time the tracking will become habitual and easy. You'll see your savings grow as your expenses decline and that will be extremely motivating! Building wealth requires hard work and discipline but if you stick with it, you will succeed.

![These Companies Will Send You Free Stickers [#05] These Companies Will Send You Free Stickers [#05]](https://images.saymedia-content.com/.image/t_share/MTczODA2NTA0NDkzOTgzMzcx/stickers-free.png)